State of Nebraska Heating Oil and Propane Program (SHOPP)

Winter Recap

Several factors influence price and supply of distillate fuel and propane. Weather, exports, OPEC+ petroleum production decisions, geopolitical incidents, refinery production, and unforeseen incidents such as the effects of a drought on the Panama Canal are just a few.

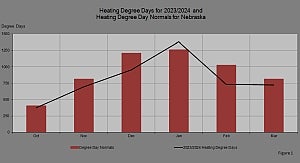

The winter of 2023/2024 in Nebraska was 12 percent warmer than normal indicating fewer winter storms and higher temperatures. Weather is always the wild card in the winter season. There was one notable winter storm, Winter Storm Gerri, which occurred mid–January 2024. January did have more heating degree days than normal. (Figure 1)

Announced in April 2023, the Organization of the Petroleum Exporting Countries and its allies (OPEC+) said in a statement it would extend a petroleum production cut of 1.65 million barrels per day until the end of 2025. In November of 2023, OPEC+ announced a voluntary production cut of 2.2 million barrels per day aimed at supporting the stability and balance of oil markets. These voluntary cuts were calculated from the 2024 required production level as per the 35th OPEC Ministerial Meeting held on June 4, 2023, and were in addition to the voluntary cuts previously announced in April 2023. These additional voluntary cuts started the 1st of January, 2024, and continued until the end of March 2024. The above was to be in addition to the announced voluntary cut by the Russian Federation of 500 thousand barrels per day for the same period (starting the 1st of January until the end of March 2024), and would consist of 300 thousand barrels a day of crude oil and 200 thousand barrels per day of refined products.

The Panama Canal had been enduring an historic drought in 2023. But water increased in the Panama Canal in November and December. This allowed the Panama Canal Authority to open more booking slots in mid–December and more transits and volumes to go through in January 2024 than previously planned. This was important for exports because the travel time was significantly reduced going through the Panama Canal. In December 2023, U.S. propane exports reached record levels. Increased exports were due to the highest propane price spread between the U.S. Gulf Coast and East Asia in a decade due to petrochemical and space heating demand.

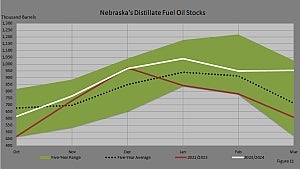

Figure 11 shows the five–year range, the five–year average, and last year's distillate inventory levels for Nebraska. Inventories were only below the five–year average during October staying above for the rest of the winter. Inventory levels stayed in the five–year range all winter. Inventories were above the previous year's stocks with the exception of December. Even then, stocks were lower only by 4,000 barrels. High refinery runs during the summer of 2023 and less consumption contributed to the increase of Nebraska distillate fuel inventories during October, November, and December. Having warmer weather most of the winter also attributed.

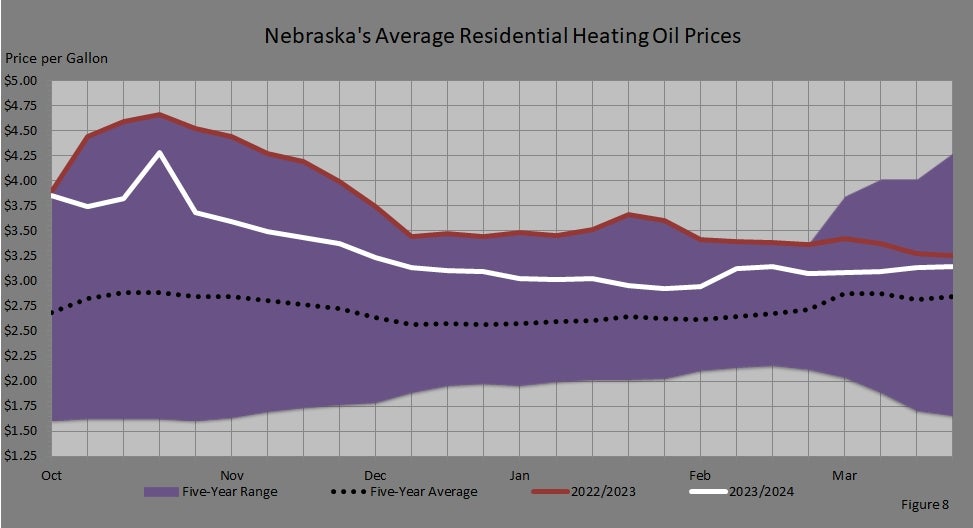

At the start of the winter heating season, the average retail price of home heating oil in Nebraska was at the top of the five–year range, equivalent to last year's price, and over a dollar higher than the five–year average. There was a price spike near the end of October due to geopolitical concerns from an attack on Israel by Hamas. For the rest of the winter, prices were relatively stable staying in the five–year range, lower than last year's prices, but yet above the five–year average. This winter's prices were lower than last year due to lower wholesale prices.

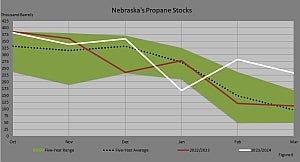

Nebraska’s inventory levels of propane were relatively volatile this winter. Levels started the season at the top of the five–year range, stayed there through December, dropped 191,000 barrels in January, jumped up 115,000 barrels in February, and fell only slightly in March. The dip in January was due to increased heating degree days during Winter Storm Gerri. Nebraskans needed to use more propane.

The price of propane was flat and above the five–year average throughout the heating season. This was probably due to the warmer–than–normal winter weather. In January, when stock levels decreased below the five–year range, there was no change in the price of propane.

Residential Propane

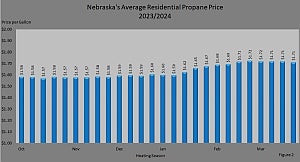

The average home heating charge price for delivery of consumer–grade propane, excluding taxes and cash discounts, in Nebraska for the 2023/2024 heating season was $1.63 per gallon. This was a 24–cent (or 13–percent) drop from last season's average price at $1.87. Propane prices are subject to both the volatility of the oil markets and natural gas production.

For the 2023/2024 season, the average retail price of propane started at $1.58 per gallon. The average price was stable throughout the season as it was during the last winter season. The 2023/2024 season though was 30 cents per gallon lower. The fourth week of March, or the end of the season, had a price of $1.71 per gallon. This price was 13 cents higher than the price at the beginning of the heating season. (See Figure 2.) Prices reported on the survey each week were dependent upon when a retailer bought a load of propane from their supplier. After buying a load of propane, the retail price would reflect the wholesale price paid along with market movements. (See Figure 5 below.)

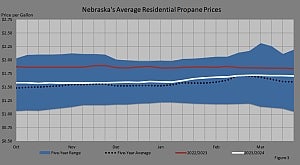

The average propane price began the 2023/2024 heating season at $1.58, 29 cents (or 16 percent) lower than the price of $1.87 at the beginning of the last heating season. As shown in this figure, the average propane prices in the 2023/2024 season were stable in the center of the five–year range, the five–year average, and last year's prices.

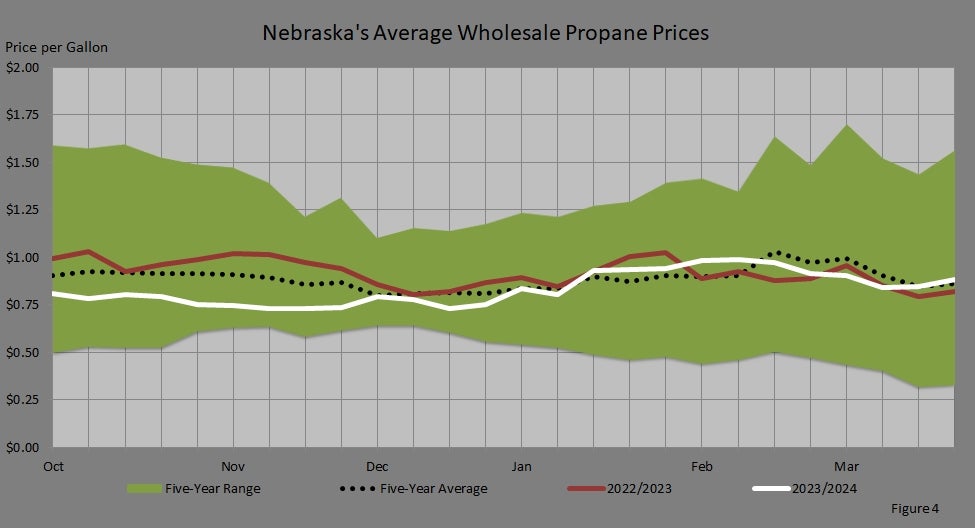

The average wholesale propane price began the 2023/2024 heating season at 81 cents, which was 18 cents lower than the price of 99 cents at the beginning of the last heating season. As Figure 4 shows, average wholesale propane prices were relatively stable while staying in the lower half of the five–year range, above and below the five–year average, and above and below last year's prices throughout the season. The wholesale price ended the season at 88 cents which was seven cents above the price at the beginning of the season (81 cents).

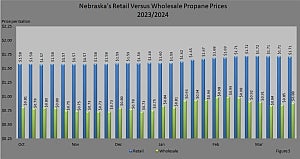

A comparison of average retail propane prices versus average wholesale propane prices in Figure 5 shows that retail prices during the 2023/2024 heating season ranged from a low of $1.57 to a high of $1.72, while wholesale prices ranged from a low of 73 cents to a high of 99 cents. Both retail prices and wholesale prices were stable.

According to EIA, Nebraska's total inventory of propane was 382,000 barrels at the beginning of the heating season in October 2023, which was 3,000 barrels (0.8 percent) below propane stocks one year earlier. Stocks started the season at the upper boundary of the five–year range, dropped below the five–year range in January (due to increased heating degree days during Winter Storm Gerri), but moved above the five–year range where stock levels stayed in February and March. Stocks ended the heating season at 233,000 barrels. (Figure 6)

Residential Heating Oil

The average home heating charge price for delivery of No. 2 heating oil, excluding taxes and cash discounts, in Nebraska for the 2023/2024 heating season was $3.29 per gallon. The season's average price dropped 47 cents (or 13 percent) from last season's average of $3.76. Heating oil prices are highly dependent on crude oil market movements.

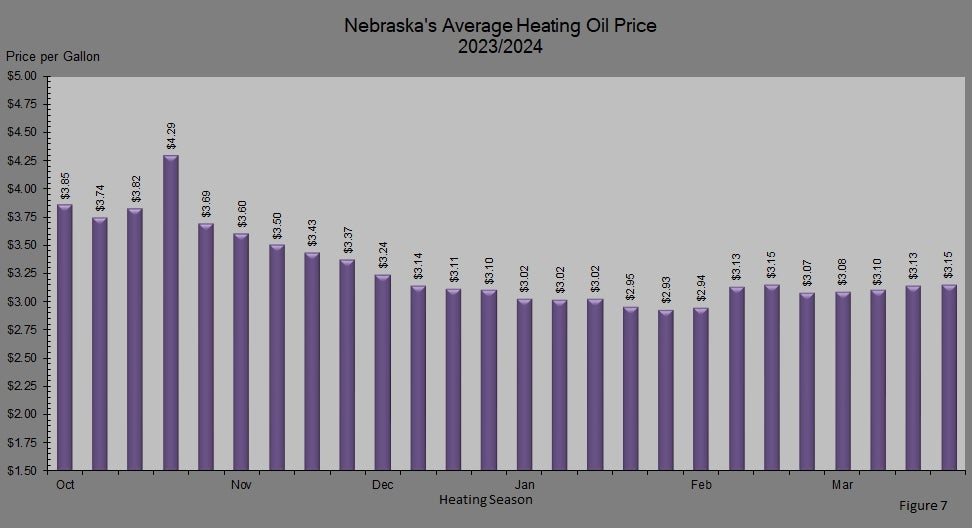

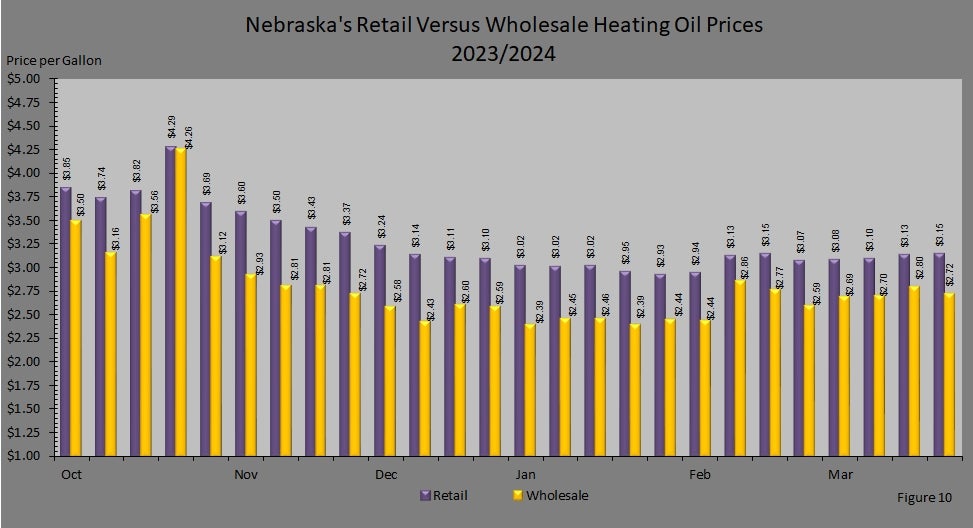

This (Figure 7) shows that the average retail price of heating oil started the 2023/2024 season at $3.85 per gallon, four cents (one percent) lower than the price of $3.89 at the beginning of the last heating season. Average heating oil prices jumped at the end of October but then decreased through February. After a slight increase the second week of February, prices were stable until the end of March. The ending price of $3.15 per gallon was 70 cents (18 percent) lower than the price at the beginning of the season ($3.85).

As Figure 8 shows, the average price of heating oil was considerably lower than last year's price with the exception of the first week in October and the last week or two of March. The price was over a dollar higher than the five–year average at the beginning of the heating season. There was a price spike the fourth week of October of almost 50 cents. At the beginning of October, global oil prices climbed over fears that the weekend attack on Israel by Hamas could escalate into a regional conflict embroiling oil–producing nations.

Even though Israel doesn't produce any oil, wary investors were pricing in "some geopolitical risk". The second week of October showed global energy prices shot higher as a cocktail of risks to supply put investors on edge. The main driver was the unfolding conflict in Israel and fears that it could spill over into the wider oil–rich Middle East region. At the end of October, when the price spiked, the World Bank had forecast that if fighting in Gaza escalated and disrupt oil supplies, prices could shoot up under the bank's worst–case scenario. In that instance, the level of disruption would be comparable to that caused by the Arab oil embargo in 1973. The average price started at the top of the five–year range but fell until February—with the exception of the price spike in October. In February, the price rose and fell. At the end of the season, the price was in the center of the five–year range.

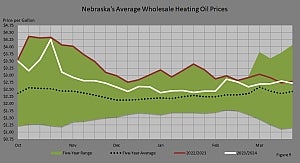

The average wholesale heating oil price began the 2023/2024 heating season at $3.50 per gallon, five cents (one percent) lower than the price of $3.55 at the beginning of the last heating season. Average wholesale heating oil prices were relatively volatile this winter. Wholesale prices also experienced the spike during the fourth week of October.

As Figure 9 shows, prices were above the five–year average the entire heating season. The average wholesale price started at the upper boundary of the five–year range and then dropped 34 cents the second week. This decrease still kept the price in the upper half of the five–year range. Prices increased in the third week and then spiked in the fourth week.

After declining from September high prices, crude oil prices increased again in early October after the Israel–Hamas conflict began. The price of Brent reached $91 per barrel on October 9. Perhaps the single biggest driver of rising oil prices had been supply cuts by Russia and the Organization of Petroleum Exporting Countries (OPEC). On September 5, Saudi Arabia announced it would be extending its one million barrel per day production cuts through at least the end of the year. In the following weeks, the prices stayed in the upper half of the five–year range until the second week in December. Prices then fell to the center of the five–year range and stayed there until the second week of February. Prices increased 43 cents and then started another descent to the upper half of the five–year range. The average wholesale price of heating oil started the season only five cents lower than last year's price. Prices were below last year's prices until the third week of March when the price was six cents above last year's price. The fourth week, the end of the heating season, the price was seven cents below last year's price.

A comparison of retail heating oil prices and wholesale heating oil prices in Figure 10 shows that, during the 2023/2024 heating season, retail prices ranged from a low of $2.93 to a high of $4.29, while wholesale prices ranged from a low of $2.39 to a high of $4.26.

According to EIA, Nebraska's total inventory of distillate fuel was 616,000 barrels at the beginning of the heating season in October 2023, which was 149,000 barrels (32 percent) above distillate fuel stocks one year earlier. Stocks started the season in the center of the five–year range but steadily increased to the upper half of the five–year range by December. From then, stocks dropped to the center of the five–year range. The winter ended with stocks close to the upper boundary of the five–year range at 954,000 barrels. Stocks were only below the five–year average in October. For the rest of the heating season, stocks were above the five–year average (Figure 11).

Heating Degree Days

The 2023/2024 winter heating season, as a whole, saw warmer–than–normal winter weather. The traditional heating season for both heating oil and propane is October through March. For this period, Nebraska normally has 5520 heating degree days. From October through March during the 2023/2024 winter season, Nebraska had 4865 heating degree days which indicates that the weather was 12 percent warmer than normal. A degree day is a 1 degree Fahrenheit difference between 65 degrees Fahrenheit and the average outdoor air temperature on a given day. The more extreme the temperature, the higher the number of degree days. The higher the number of heating degree days, the colder the weather, and the more days that Nebraskans had to heat their homes.

Looking at individual months, it was warmer–than–normal winter weather from October through December, colder–than–normal winter weather in January, and warmer–than–normal winter weather in February and March as reflected by Figure 1. The bars in Figure 1 represent the heating degree day results of normal winter weather for each month in Nebraska. The line represents the heating degree day results of the actual weather that the 2023/2024 winter season experienced.

Purpose of State Heating Oil and Propane Program Survey

The Nebraska Department of Water, Energy, and Environment (DWEE) collects residential prices of No. 2 heating oil and consumer–grade propane during the heating season (October to March) for the State Heating Oil and Propane Program (SHOPP). It is the only U.S. Department of Energy (USDOE) Energy Information Administration (EIA) survey that collects propane prices. The data are used by DWEE to monitor the prices of propane and heating oil during the winter season to maintain awareness of any price or supply irregularities that may be developing. The data is also used by policymakers, industry analysts, and consumers.

Sources: Today in Energy, (2024 March 12), U.S. Energy Information Administration, Washington, DC. U.S. propane exports established a new record in December 2023. Retrieved August 8, 2024, from https://www.eia.gov/todayinenergy/detail.php?id=61564

Short–Term Energy Outlook, U.S. Energy Information Administration, Washington, DC. https://www.eia.gov/outlooks/steo/

2023/24 Winter Propane Market Update, U.S. Energy Information Administration, Washington, DC. https://www.eia.gov/special/heatingfuels/resources/Propane_Briefing.pdf

This Week in Petroleum, U.S. Energy Information Administration, Washington, DC. https://www.eia.gov/petroleum/weekly/

Cable News Network (CNN), (2023 October 9). Oil price spikes on Israel war. Here's what a wider conflict might mean. Retrieved July 24, 2024, from https://www.cnn.com/2023/10/09/energy/oil-prices-israel-hamas-conflict-explainer/index.html

Cable News Network (CNN), Anna Cooban, 2023 October 13. Oil and gas prices are climbing again as supply risks multiply. Retrieved July 24, 2024, from https://www.cnn.com/2023/10/13/energy/oil-gas-price-rises-global-risks-mount/index.html

Cable News Network (CNN), (2023 October 23). Oil prices fluctuate as concerns mount over Middle East tensions. Retrieved July 24, 2024, from https://www.cnn.com/2023/10/16/investing/global-markets-oil-intl-hnk/index.html

Cable News Network (CNN), Anna Cooban, (2023 October 30). Oil prices are falling even as Israel steps up its war on Hamas. A spike could still happen. Retrieved July 24, 2024, from https://www.cnn.com/2023/10/30/economy/oil-prices-israel-gaza-offensive/index.html

Cable News Network (CNN), Anna Cooban, (Updated 2024, June 3). OPEC+ extends oil output cuts into 2025. Retrieved August 7, 2024, from https://www.cnn.com/2024/06/02/business/opec-oil-production-cuts-2025/index.html#:~:text=The%20group%20said%20in%20a,the%20end%20of%20this%20year.

Average Residential Propane Prices in Nebraska and Average Residential Heating Oil Prices in Nebraska. Nebraska Department of Water, Energy, and Environment, Lincoln, NE.